Silicon Sovereignty: How Chip Manufacturing Became the World’s Most Dangerous Monopoly

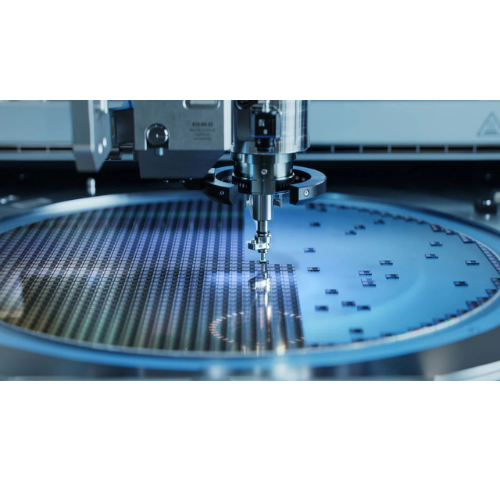

In the digital age, semiconductors are the lifeblood of everything from smartphones and electric vehicles to artificial intelligence and national defense systems. Yet, the manufacturing of the world’s most advanced chips—those below 5 nanometers—is concentrated in a handful of locations, creating a precarious geopolitical and economic imbalance.

The Geography of Silicon: Where Advanced Chips Are Made

Taiwan, South Korea, and the United States dominate the production of cutting-edge semiconductors:

- Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Company) leads the pack, producing over 90% of the world’s most advanced chips, including 3nm and 2nm nodes.

- Samsung in South Korea follows, though it struggles with yield rates compared to TSMC.

- Intel in the U.S. is ramping up its 18A process (1.8nm class), but mass production is still in early stages.

This geographic concentration means that a single earthquake, military conflict, or political disruption could cripple global tech supply chains.

Geopolitical Tensions: Chips as Strategic Assets

Semiconductors are strategic assets. Governments now view chip manufacturing as a matter of national security:

- U.S.–China rivalry has intensified, with Washington imposing export controls on advanced chip technologies and equipment to limit Beijing’s access.

- China’s response includes massive investments in domestic chip production and restrictions on rare earth exports, which are critical for chipmaking.

- Europe and Japan are launching subsidy programs to attract chipmakers and reduce dependence on Asia.

This geopolitical tug-of-war is reshaping the semiconductor landscape, with billions in subsidies and trade restrictions fueling a global chip race.

Risks of Concentration: Fragility in the Supply Chain

The current concentration of chip manufacturing poses several risks:

1. Supply Chain Vulnerability A disruption in Taiwan—whether due to natural disaster or geopolitical conflict—could halt production for companies like Apple, Nvidia, and Qualcomm.

2. Economic Shockwaves Advanced chips power critical sectors. A shortage could lead to billions in lost revenue, delayed product launches, and inflationary pressures across industries.

3. National Security Threats Military systems, satellites, and cybersecurity infrastructure rely on advanced chips. A lack of access could compromise defense capabilities.

4. Innovation Bottlenecks If only a few players control advanced nodes, innovation could slow down due to limited access and rising costs.

Economic Impact: Who Wins, Who Loses?

| Region | Impact of Chip Concentration |

|---|---|

| United States | Vulnerable to supply shocks; investing in reshoring |

| China | Struggling to catch up; reliant on older nodes |

| Taiwan | Economic powerhouse but geopolitically exposed |

| South Korea | Competitive but yield issues persist |

| Europe | Lagging behind; launching subsidy programs |

The Push for Diversification

Governments and corporations are now racing to diversify chip manufacturing:

- Intel and TSMC are building new fabs in Arizona and Ohio.

- Samsung is expanding in Texas.

- Europe’s Chips Act aims to double its global market share by 2030.

- Japan and India are offering incentives to attract chipmakers.

However, building advanced fabs takes years and billions of dollars, and skilled labor shortages remain a major hurdle.

The Future of Silicon Sovereignty

The concentration of advanced chip manufacturing in a few geographic hotspots has turned semiconductors into geopolitical chess pieces. As nations scramble to secure their digital futures, the race to decentralize chip production will define the next decade of global economic and technological development.